Credit & Financial Education Services

Helping individuals and families learn about credit and financial information since 2006

Click the Learn More button below to set up an appointment.

Products – Ebooks, Documents, Audio Book, Consulting Services.

Refund Policy – 30 Day Refund Available on all products and services.

Customer Service Phone 9:00 am to 5:00pm Central Time Zone

Customer Service Phone Number 414-374-3390

Customer Services Email sawilliams@therealdebtsolution.com

Leaders in online and in person credit and financial education.

Our mission is to help our community learn more about how personal and business credit can affect our lives and financial future.

We strive to help individuals and families move towards a more financially secure future through our education services.

Contact Us

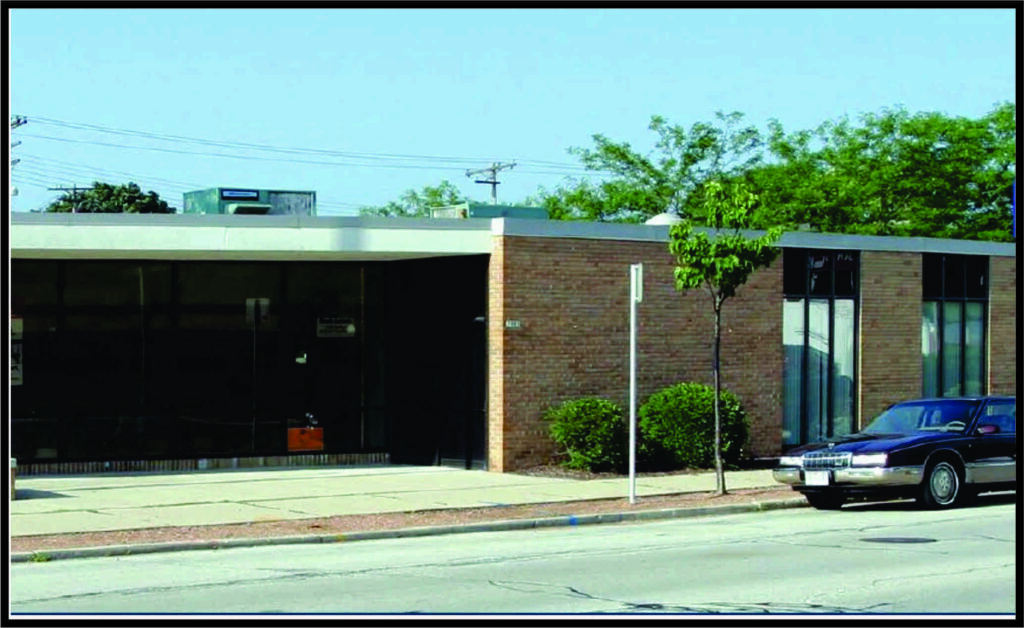

7901 W. Burleight St

Milwaukee, WI 53222

sawilliams@atherealdebtsolution.com

(262)880-6964